Enhanced Order Book Samples

Order action sample

The Order event represents an abstract sequence of Order Actions. See the Order Action sample with omitted Symbol=IBM and Side=Buy in the following table:

Description | Action | Order ID | Price | Size | Executed Size | AuxOrder ID | Trade ID | Trade Price | Trade Size |

|---|---|---|---|---|---|---|---|---|---|

New order #10001 for "Buy 100 IBM @ 123.35" | NEW | 10001 | 123.35 | 100 | 0 | - | - | - | - |

Reduce size for #10001 by 20 | MODIFY | 10001 | 123.35 | 80 | 0 | - | - | - | - |

Update order #10001 with "Buy 100 IBM @ 123.45" | REPLACE | 10001 | 123.45 | 100 | 0 | - | - | - | - |

Order #10001 is executed for 20 with Trade #50001 and Price 123.44 | PARTIAL | 10001 | 123.45 | 80 | 20 | - | 50001 | 123,44 | 20 |

Order #10001 is executed for 80 with Trade #50002 by aggressor Order #10020 | EXECUTE | 10001 | 123.45 | 0 | 100 | 10020 | 500002 | 123,45 | 80 |

Non-Book Trade #50010 for "Buy 1000 IBM @ 123.7" | TRADE | - | - | 0 | 0 | - | 50010 | 123,7 | 1000 |

Trade Bust for #50010 | BUST | - | - | 0 | 0 | - | 50010 | - | - |

New order #10002 for "Buy 100 IBM @ 123.55" | NEW | 10002 | 123.55 | 100 | 0 | - | - | - | - |

Cancel/Replace order #10002 with new order #10003 for "Buy 120 IBM @ 123.66" | DELETE | 10002 | 123.55 | 100 | 0 | 10003 | - | - | - |

NEW | 10003 | 123.66 | 100 | 0 | 10002 | - | - | - |

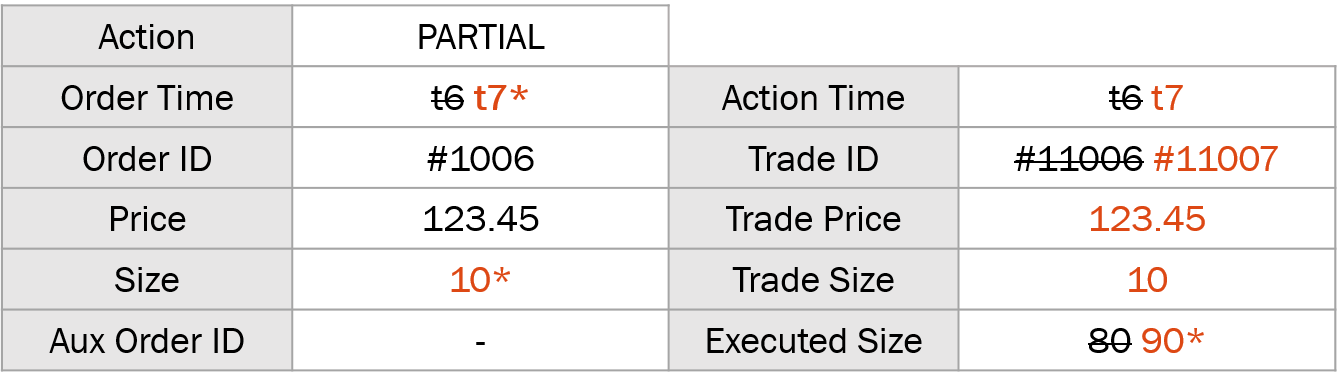

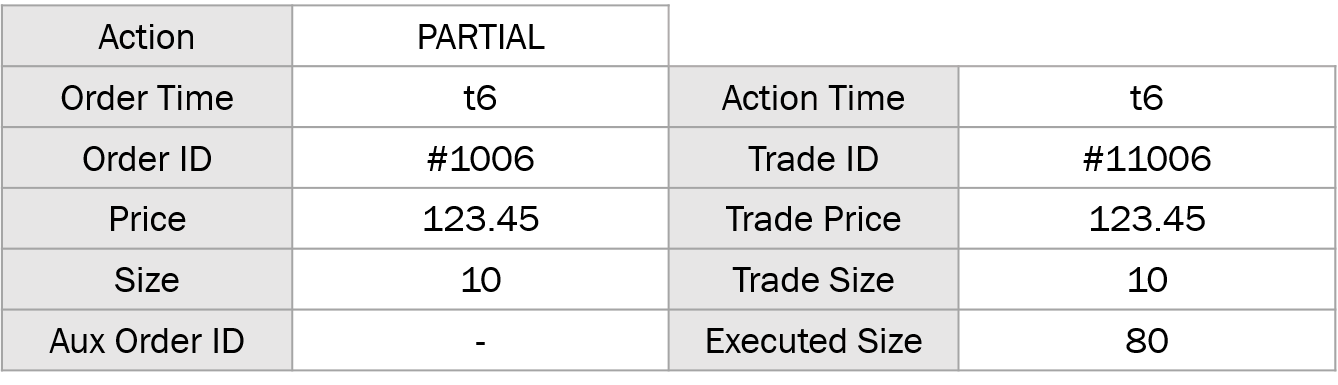

Iceberg order sample

The below example shows the typical process of the iceberg order. Consider the situation that:

There is an executed order

#1006. It's already partially executed for80and the latest trade is10.

When the new order ID

#1007comes, Icebergs usually re-enter the Order Book and lose their price-time priority. Therefore, the order and action time increase, and the executed size grows. The action and all other data remain the same.