dxLibOptions Library

dxLibOptions

dxLibOptions is a library that provides several arb-free pricing algorithms for options, as well as various helper algorithms. Below is short summary for provided algorithms as well as pointers to detailed descriptions and proofs.

Option pricing algorithms

Binomial Tree Pricing

Class:com.devexperts.options.pricing.BinomialTreePricing

Directly provided results: price, delta, gamma.

Suitable for: log normal vanilla American and European options without dividend schedule.

Complexity: , where - number of steps.

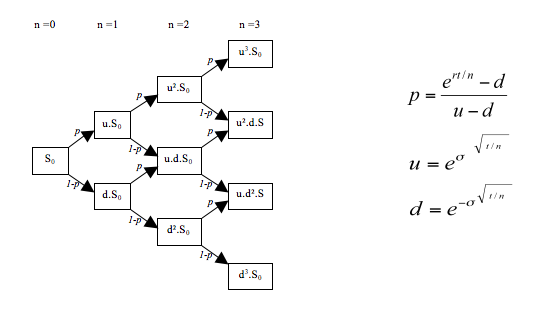

Algorithm divides time until expiration into given number of equal segments. During each segment stock goes either up or down in price. There are two methods to calculate prices and probabilities: Cox-Ross-Rubinstein and Leisen-Reimer. Cox-Ross-Rubunstein tree example:

Further reading:

"Binominal Models for Option Valuation - Examing and Improving Convergence" by Dietmar Leisen and Matthias Reimer (original document can be found here)

Bjerksund-Stensland Pricing

Class: com.devexperts.options.pricing.BjerksundStenslandPricing

Directly provided results: price

Suitable for: log normal vanilla American options without dividend schedule.

Complexity:

Algorithm uses Black-Scholes model with one or two early exercise strategies:

One boundary method uses precalculated boundary .

Two boundary method uses precalculated boundary until time and precalculated boundary afterwards.

Further reading: "Numerical Methods versus Bjerksund and Stensland Approximations for American Options Pricing" by Marasovic Branka, Aljinovic Zdravka, Poklepovic Tea Section IV. (Original document can be found here).

Black-Scholes Pricing

Class: com.devexperts.options.pricing.BlackScholesPricing

Directly provided results: price, delta, gamma, theta, vega, rho, phi, carry_rho, speed, vanna, vomma, ultima, zomma, charm, veta, color, totto, strike_delta, strike_gamma.

Suitable for: log normal vanilla and binary European options without dividend schedule.

Complexity:

Algorithm uses Black-Scholes model, namely it has following assumptions about market:

There is constant risk-free interest rate and there is fee free opportunity to borrow or lend any amount of cash (even fractional) at this rate.

Stock price is geometric Brownian motion with constant drift and volatility and there is fee free opportunity to buy and sell (including short sell) the stock at this price.

Stock pays constant continuous dividends.

There is no arbitrage opportunity.

Further reading: Black-Scholes model.

Black-Scholes Universal Pricing

Class: com.devexperts.options.pricing.BlackScholesUniversalPricing

Directly provided results: price, delta, gamma, theta, vega, rho, phi, vanna, vomma.

Suitable for: log normal vanilla, binary, single/double barrier (European payout for KO rebates) and single/double touch/no-touch European options without dividend schedule.

Complexity:

Algorithm uses Black-Scholes model with border condition to solve barrier and touch options.

Further reading: "Barrier options" (original document can be found here)

Explicit Finite Difference Pricing

Class: com.devexperts.options.pricing.ExplicitFiniteDifferencePricing

Directly provided results: price, delta, gamma, speed, theta, charm, color.

Suitable for: log normal vanilla, binary, single/double barrier and single/double touch/no-touch European and American options without dividend schedule.

Complexity: , where - number of steps.

Algorithm uses finite difference method to solve Black-Scholes equation.

Further reading: "Numerical Approximation of Black-Scholes equation" by Dina Dura and Ana-Maria Moşneagu (original document can be found here)

Merton-Reiner-Rubinstein Barrier Pricing

Class: com.devexperts.options.pricing.MertonReinerRubinsteinBarrierPricing

Directly provided results: price, delta, gamma, speed, theta, charm, color.

Suitable for: log normal single barrier (American payout for KO rebates) European options without dividend schedule.

Complexity:

Algorithm uses Black-Scholes model modified to account for single barriers.

Further reading: E. G. Haug "The complete guide to options pricing formulas"

Monte-Carlo Pricing

Class: com.devexperts.options.pricing.MonteCarloPricing

Directly provided results: price, delta, gamma, speed, theta, charm, color.

Suitable for: log normal vanilla European options.

Complexity: , where - number of steps.

Algorithm uses Euler method on geometrical Brownian motion.

Further reading: "Monte Carlo and Binomial Simulations for European Option Pricing" by Robert Hon Section 3.2.1 (original document can be found here).

Other algorithms

Finite difference derivative

Class: com.devexperts.options.pricing.FiniteDifferenceDerivativeImpl

For all the greeks not provided by pricing algorithms calculation is done using finite difference derivative approximation. There is no need to do anything as any pricing algorithm will use this method if it do not support corresponding greek internally.

Further reading: Finite difference

Yield curve

Class: com.devexperts.options.pricing.YieldCurve

Given prices of bonds with different expirations constructs interest rate curve for currency. Support bonds with and without coupons.

Further reading: "Methods for Constructing a Yield Curve" by Patrick S. Hagan and Graeme West (original document can be found here).

Examples

Info

You can use any compatible pricing algorithm like in the examples below.

Pricing vanilla option – Black-Scholes

VanillaParams p = new VanillaParams(); p.setUnderlying(100); p.setStrike(110); p.setExpiration(0.5); p.setVolatility(0.2); p.setInterestRate(0.01); p.setDividendYield(0.03); p.setStyle(OptionStyle.EUROPEAN); p.setPayoff(OptionPayoff.CALL); BlackScholesPricing pr = new BlackScholesPricing(); double price = pr.computePrice(p);

Pricing vanilla option – Bjerksund-Stensland

BjerksundStenslandPricing pricing = new BjerksundStenslandPricing(); pricing.setVariant(BjerksundStenslandPricing.Variant.ONE_BOUNDARY); VanillaParams params = new VanillaParams(); params.setExpiration(3); params.setStyle(OptionStyle.AMERICAN); params.setInterestRate(0.08); params.setStrike(100); params.setVolatility(0.2); params.setDividendYield(0.12); params.setUnderlying(80); params.setPayoff(OptionPayoff.PUT); pricing.computePrice(params);

Pricing double barrier option

VanillaParams p = new VanillaParams(); p.setStrike(100); p.setUnderlying(90); p.setExpiration(100d / 365); p.setVolatility(0.22); p.setInterestRate(0.0078); p.setDividendYield(-0.004); p.setPayoff(OptionPayoff.CALL); VanillaBarrierOptionParams bp1 = new VanillaBarrierOptionParams(); bp1.setBase(p); bp1.setBarrier(84); bp1.setBarrierType(BarrierType.DOWN_OUT); VanillaBarrierOptionParams bp2 = new VanillaBarrierOptionParams(); bp2.setBase(bp1); bp2.setBarrierType(BarrierType.UP_IN); bp2.setBarrier(104); BlackScholesUniversalPricing pricing = new BlackScholesUniversalPricing(); UniversalParams up = new UniversalParams(p, bp2); double price = pricing.computePrice(up);

Building yield curve

double[] maturity = {1, 2, 3, 5, 7, 10, 20, 30};

double[] input = percentToFractions(0.60, 0.78, 0.91, 1.18, 1.44, 1.57, 1.90, 2.23);

YieldCurve constantResult = YieldCurve.bootstrap(maturity, input, 2, YieldCurve.BootstrappingMode.CONSTANT_RATE);

YieldCurve changingResult = YieldCurve.bootstrap(maturity, input, 2, YieldCurve.BootstrappingMode.CHANGING_RATE);