Options Analytics Solution

Why dxPrice?

Model-free algorithm

The dxPrice Engine works well on both low and high liquidity markets as well as in cases of high volatility.

The Engine provides the prices that fit the market best.

Prices are arbitrage-free across the option class.

The algorithm provides smooth price and volatility curves.

Real-time processing

The dxPrice engine is fast enough to be used in real-time even for the highest-volume data feeds like the OPRA option universe.

Historical data

Historical data generated by dxPrice is available through dxFeed standard APIs.

All-in-one-Feed

dxFeed APIs unites the raw market data, reference data and option analytics feeds under one umbrella, providing clients with a single point of entry for any market data needs.

Individual option-level analytics

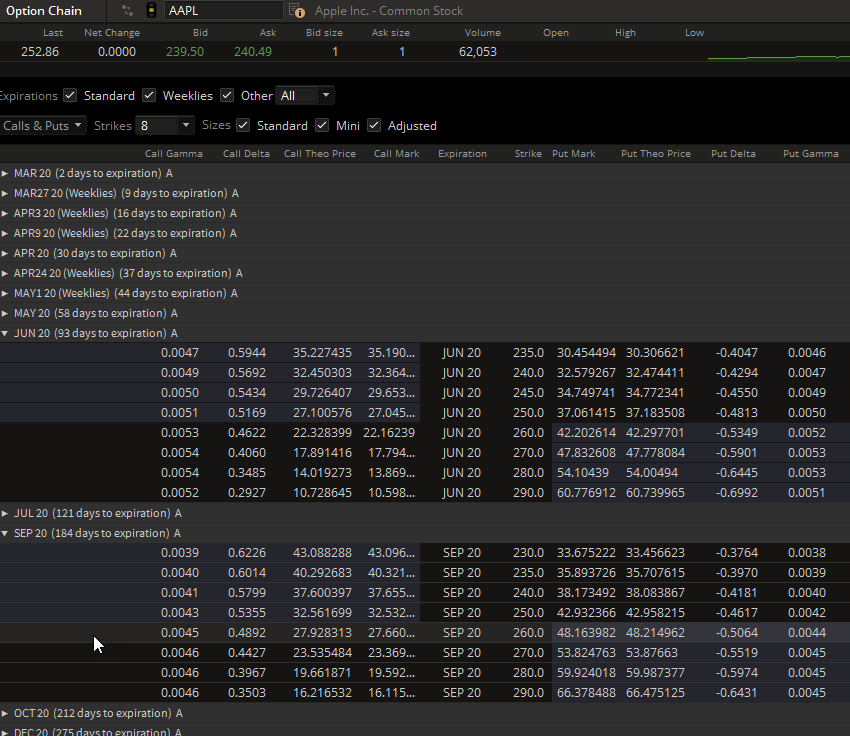

TheoPrice and Greeks are records containing analytical attributes for every individual option and distributed via the feed. For more info on the structures of records and attribute definition please check TheoPrice and Greeks events.

A simple demo UI for the dxPrice results can be found here (for symbols specifications please check the Instrument Profile Format documentation).

Theoretical option price

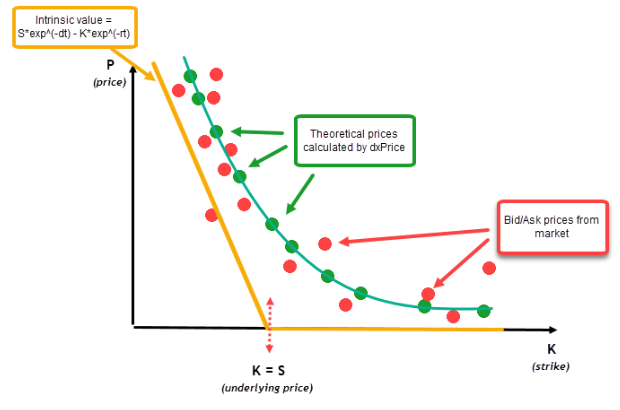

Theoretical option price is a fair market value of an option that should be as close to the market data as possible, while at the same time conforming to the arbitrage-free conditions. dxPrice engine does not use any model for option valuation. Instead, it derives prices from the entire set of bids and offers available for an option series. The resulting prices:

Are smooth across the series and arbitrage free

Reflect the market well

Are provided even for low liquid options

It is an important benefit that the algorithm is model-neutral, and therefore it works well on all kinds of asset classes (in the feed one can find futures, index, commodity and equity options priced using the same algorithm). We use cubic splines to approximate option’s objective prices. The resulting spline curve is finally considered as a fair options price curve. We rewrite arbitrage-free conditions as linear constraints on the spline’s parameters and obtain a strictly convex quadratic optimization problem.

Implied risk-free and dividend rates

Risk-free and dividend rates are essential parameters for any option pricing model. The model-free approach used by dxPrice for price estimation allows us to derive implied rates per option series based on the theoretical price and call-put parity equation. Both of these values aren’t necessarily non-negative as they represent a mix of different factors and correspond to effective dividends and interests experienced by option market makers.

Implied rates are time-dependent and are distributed in TheoPrice and Series records in the following format:

Implied Risk-free rate:

Implied dividend rate:

where and are yearly risk-free and dividend rates. The rates presentation was chosen to allow users to have higher precision of the most commonly used math expressions in the financial math sphere, e.g.

Info

Only European options satisfy put-call parity equation - see the Options Guide. Implied rate for all other option types are assumed to be 0.

Greeks and Implied Volatility

As the option price does not always appear to move in conjunction with the price of the underlying asset, it is important to understand which factors contribute to the movement in the price of an option and what effect they have. Using theoretical prices and implied rates dxPrice engine derives Delta, Gamma, Vega, Theta and Rho that allow our users to get more deep insights on the reasons for option price changes.

Implied volatility shows the volatility of an underlying asset expected by option traders. The dxPrice engine calculates the value and provides it to our users in an easily accessible manner.

Unlike all other indicators, Greeks and implied volatility are derived using the analytical formulas of Black-Scholes model. Model-free price and implied rates are used as an input parameters to the model.

Non-standard options valuation

The options market allows the players to trade products with various underlyings and their configurations that the trader then has to keep in mind. Such wide variability attracts more players to the market, as it meets the requirements of even the most demanding traders. On the other side, it increases the complexity that the model developers have to factor in their options analytics calculations. There are multiple variants of non-standard options, for example:

Options with quotes inconsistent with the full price of a comparable option with just one asset per contract (MULTIPLIER <> SPC in IPF)

Options with multiple underlying assets or additional cash (ADDITIONAL_UNDERLYINGS field is not empty in IPF)

The dxPrice engine includes the appropriate normalization procedure to handle such complex situations. Users, however, need to be aware that calculated values can be way off their expected values for such options because of the non-standard quotation (e.g. delta <> 0.5 for ATM Call options).

Series and Underlying level Analytics

The Series and Underlying records are distributed in the feed and provide users with some analytical indicators calculated for option series and/or chains (underlying group). For definitions of:

option series in terms of dxFeed, please refer to Option Series

option chain - please refer to Option Chain

records - please refer to the Series and Underlying articles respectively

A simple demo UI for the dxPrice results can be found here (for symbols specifications please check the Instrument Profile Format documentation).

VIX-style implied volatility

Implied volatility is used by investors to estimate the volatility of the underlying asset expected by option traders. Implied volatility of a series or a chain is a VIX-like index calculated per the respective universe of options (see methodology of VIX). Apart from the the final index value for the option chain, dxFeed provides insights on the implied volatility of series that were chosen according to the VIX methodology for option chain volatility calculation.

Forward Price

The dxPrice engine provides investors with the expected forward price of the underlying asset. The price is calculated per every option series and distributed via the feed.

Put/Call Ratio

The ratio allow investors to see the market expectation of the underlying price movement. Greater volume on Put options than Call options can indicate that market players expect the underlying price to go down, and vice versa. The indicator is provided on both option series and chain level for more informative investment decisions.

Volatility surface

Volatility surface is a powerful tool, providing option traders with insight on computing the forward volatilities, which can be used for pricing of option products. The dxFeed methodology allows one to build volatility curves even for low liquidity markets, where option series do not have a whole set of strikes.